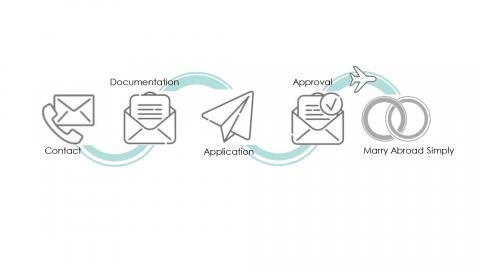

CONTACT US FOR A FREE NO OBLIGATION DOCUMENTS LIST HERE.

Many German residents and Citizens contact us around the time of year when their taxes are submitted as they realise that if you are married you benefit from certain better tax rates and privileges.

Please note that tax laws and regulations may change over time, so it's essential to consult with a tax professional or the latest government sources for the most up-to-date information. In Germany, there are some potential tax benefits for married couples:

-

Joint Assessment (Splitting): Married couples can choose to have their income jointly assessed for tax purposes. This means that their combined income is used to calculate their income tax. This can be beneficial if one spouse earns significantly more than the other since it may result in a lower overall tax liability.

-

Spousal Deduction: Married couples are entitled to a spousal deduction (Ehegattensplitting). This can result in lower overall income tax because the tax rate brackets for couples are wider than for single individuals.

-

Estate and Gift Tax Benefits: Inheritance and gift tax laws often provide exemptions or reduced tax rates for transfers of assets between spouses. This can be beneficial in terms of estate planning and wealth transfer.

-

Tax Credits: There are certain tax credits and deductions in Germany that married couples can take advantage of, such as child-related tax benefits (e.g., Kindergeld and Kinderfreibetrag) and other family-related tax credits.

-

Choice of Filing Status: In Germany, married couples have the option to file taxes jointly (Zusammenveranlagung) or separately (getrennte Veranlagung). Choosing the right filing status can impact your overall tax liability.

It's important to note that while there can be tax benefits to being married in Germany, the extent of these benefits depends on various factors, including the income of each spouse, the presence of children, and other individual circumstances. The German tax system is complex, and tax benefits may vary from one case to another.

To fully understand the tax implications of marriage in Germany and to optimize your tax situation, it's advisable to consult with a tax advisor or accountant who is knowledgeable about German tax laws and regulations, especially considering that these laws may change over time.

So to recap - Tax deductible marriages in Denmark for German tax payers are a reality of life, that as well as love and being with your soul mate, there are many other reasons you need to elope and have Town Hall or Registry office weddings.

These can be financial or practical - because you need to get married fast and easily, for documentation reasons to stay living in the same country, due to a difference in religions, family rifts, impending babies, you just want something low key – the list is endless!

When you are considering getting married abroad a big factor is cost and how much it is going to set you back to have a wedding abroad. You already have to factor in the cost of travel when you are looking at the easiest place to marry abroad, flights, hotels, meals out. Although the financial savings of an elopement likely will cover these costs and some when you off set it against the savings of a large wedding party with food, drink and entertainment for both sides of the family to celebrate the registering of your wedding!

Nothing like a wedding to drain you financially as everything with weddings seems to be inflated in cost, and it is all of a sudden imperative to have table decorations matching with bridesmaids undergarments at the equivalent cost of a small family car!!

Luckily if you are a German tax resident though you have little known savings and tax breaks available to you, which you can claim back in your annual return – making weddings abroad an even more attractive option for you! It is possible to marry in a registry office in Denmark and be over the German border, married and return to Germany all in the same day – obtain a tax receipt and invoice from the Danish Government office or Agency you are working with to reclaim this with your accountant on your annual return! To take the cost of getting married a little more manageable! This is a little known tax break, and certainly makes marrying abroad a cheaper option for German Tax residents, and can help with weddings abroad on a budget if you qualify.

Have a look at our awesome YouTube channel for short information Vlogs on how easy it is to elope and get married abroad!

Please contact us anytime via our contacts page by clicking here by e-mail at [email protected] or call us on +447934933356 or what’s app +4571493483

We would love to hear from you!

For more information contact a reputable wedding Agency or Tax rebate and refund company to advise further. www.taxback.com www.marryabroadsimply.com,

CONTACT US FOR A FREE NO OBLIGATION DOCUMENTS LIST - HERE